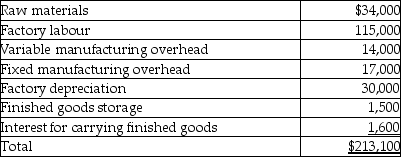

Comfy Feet manufactures slippers. In 2011, the company hired a new bookkeeper who did not have appropriate training. The bookkeeper charged all of the following costs for manufacturing 70,000 pairs of slippers to "Production Expense."

The company had zero work-in-process at the end of both 2010 and 2011. Finished goods amounted to 20,000 pairs at $9.00 per pair at the end of 2010. There were 6,500 pairs in finished goods inventory at the end of 2011.

The company had zero work-in-process at the end of both 2010 and 2011. Finished goods amounted to 20,000 pairs at $9.00 per pair at the end of 2010. There were 6,500 pairs in finished goods inventory at the end of 2011.

Required:

a. Provide the adjusting journal entry or entries at Dec 31, 2011 to correct the bookkeeper's errors and properly record the above expenditures recorded in the "Production Expense" account.

b. Assume the company uses a periodic inventory system and the FIFO cost flow assumption for finished goods. Calculate the cost of goods sold and the ending value of finished goods inventory for the year 2011.

c. Now assume the company uses the weighted-average cost flow assumption. Calculate the cost of goods sold and the ending value of finished goods.

Definitions:

Q18: Bountiful Corporation has the following investment portfolio

Q42: Sahil Inc. reported credit sales of $600,000

Q55: Which statement describes the "full cost" method?<br>A)A

Q59: Based on the following information, what amount

Q66: Assume that a company has a fiscal

Q72: Company Twelve purchased land for $900,000 some

Q73: Company One purchased land for $900,000 some

Q75: Which statement is correct?<br>A)Costs can continue to

Q124: What is the meaning of "significant influence"?<br>A)The

Q138: Determine the missing amounts: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2820/.jpg" alt="Determine