Willow Corp. is a real estate developer with its headquarters in Burlington, Ontario.

As a result of recent increases in land prices, Willow has accumulated a substantial amount of excess cash. It is looking to invest in a building supply company, but has not yet found a suitable company. To earn a reasonable return and to minimize risk, Willow invests its excess cash in common shares of large, stable corporations.

1. On Jan 1, 2011, Willow paid $1,080,000 to purchase 120,000 common shares of North Line.

2. On December 27, 2011, North Line declared and paid a dividend of $0.25 per common share.

3. On December 31, 2011, the market value of the common shares was $1,200,000.

4. On June 30, 2012, Willow sold the common shares for $1,620,000.

Required:

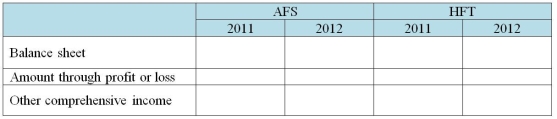

Using the following table, indicate the amounts to be reported in the balance sheet, through profit or loss, and through other comprehensive income for 2011 and 2012 under two scenarios:

a. Willow designates the common shares as an available-for-sale (AFS)investment.

b. Willow designates the common shares as a held-for-trading (HFT)investment.

Definitions:

Unsatisfying Hotel

A hotel that fails to meet the expectations or satisfaction levels of its guests.

Quality Loss Function

A mathematical formula that quantifies the cost associated with producing items that deviate from target specifications, introduced by Genichi Taguchi.

Pareto Diagram

A graphical representation that displays the relative importance of differences within a set of data, usually to identify which factors are the most significant.

Cause-and-Effect Diagram

A visual tool that helps identify, sort, and display possible causes of a specific problem or quality characteristic.

Q9: What is the meaning of "joint control"?<br>A)Ability

Q31: In 1991 the Argentine peso was fixed

Q37: Explain the accounting for assets related to

Q49: The _ approach states that the exchange

Q77: What costs should not be capitalized to

Q83: Discuss how inappropriate capitalization of costs during

Q101: How is income and expense recognized for

Q103: Based on the following information, what is

Q103: Assume that a purchase invoice for $1,000

Q118: Fruit Valley Inc. reported cash sales of