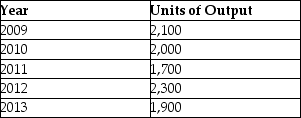

Plastic Moulds purchased equipment on January 1, 2009 for $275,000. It was estimated that the equipment would have a residual value of $25,000 at the end of its useful life. The asset's useful life was estimated at 5 years or 10,000 units of output. The company has a December 31 year end. Additional information:  Assuming the company uses the units-of-production depreciation method, what is the depreciation rate per unit for 2009?

Assuming the company uses the units-of-production depreciation method, what is the depreciation rate per unit for 2009?

Definitions:

Direct Labour Budget

A financial plan that estimates the cost of direct labor required to meet production goals.

Selling

The process of promoting and selling goods or services, including marketing and advertising strategies.

Administrative Expense

Expenses incurred in the process of running a company that are not directly tied to a specific product or service, such as salaries of senior executives.

Responsibility Accounting

A system of accountability in which managers are held responsible for those items of revenue and cost—and only those items—over which they can exert significant control. The managers are held responsible for differences between budgeted and actual results.

Q38: Johnson Ltd. began operations on January l,

Q44: What is the meaning of "exit value"?<br>A)The

Q45: An important thing to remember about foreign

Q52: Explain why non-current assets held for sale

Q73: Under IFRS, what is the acceptable treatment

Q77: Soorya Resources incurred the following costs: <img

Q80: Fiesta Corp. purchases a $500,000 face value

Q81: A particular production process requires two types

Q97: Explain why it is important to segregate

Q133: Amacon Corporation has the following investments at