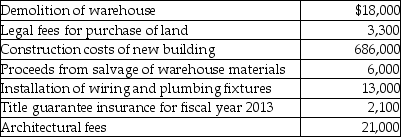

Grape Company (GC)had been renting an office building for several years. On January 1, 2013, GC decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $350,000. Other costs included the following:

Required:

Required:

a. Calculate at what amount GC should record the (i)land and (ii)building.

b. Assume that the building was completed and occupied on December 31, 2013. It has an estimated useful life of 40 years, with residual value of $140,000. Calculate depreciation for 2014 using (i)the straight-line method and (ii)the double declining balance method.

c. Assume that management decided to use straight-line depreciation for the building. By 2017 GC had

grown considerably and needed to relocate for more space; it sold the land and building to Macaw Company on July 1, 2017 for $1,350,000. Assume depreciation expense has already been recorded for the first six months of the year (Jan. 1, 2017 to June 30, 2017). Prepare all journal entries required relating to the land and building accounts on July 1, 2017.

Definitions:

Sociocultural Approach

A perspective in psychology that examines how social and cultural environments influence behavior, thought processes, and emotions.

Systems Perspective

An analytical framework that views entities as part of larger, interconnected systems, emphasizing the interdependence of parts within the whole.

Psychometric Study

involves the science of measuring mental capacities and processes through various tests and assessments.

Naturalistic Observation

A research method where subjects are observed in their natural environment without any manipulation by the researcher.

Q36: Based on the following information, what is

Q44: Which statement is correct about variable costing?<br>A)Under

Q48: Jasper Pernik is a currency speculator who

Q48: If a market basket of goods cost

Q55: Which factor will affect the estimated useful

Q57: Accounting standards provide for a variety of

Q68: A speculator in the futures market wishing

Q79: Why is it important to understand the

Q109: Which of the following is a potential

Q111: Explain what problems are created for the