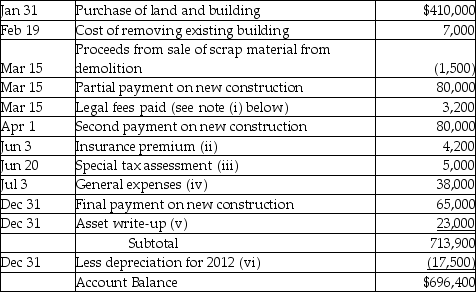

Zach Co. Ltd. was incorporated on January 2, 2012, but was unable to begin their manufacturing operations immediately. The new factory facilities became available for use on July 1, 2012. During the start-up period, the company provisionally used a "Land and Factory Building" account to record the following transactions, in chronological order:

Additional info

Additional info

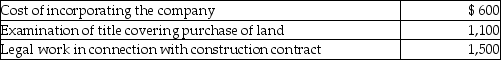

i. Legal fees of $3,200 covered the following:

ii. Insurance covered the building for a one-year term beginning April 1, 2012.

ii. Insurance covered the building for a one-year term beginning April 1, 2012.

iii. The special tax assessment covered repaving the street in front of the building.

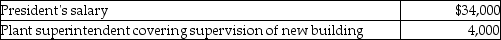

iv. General expenses covered the following for the period January 2, 2012 to June 30, 2012.

v. The board of directors increased the value of the building by $23,000, believing that such an increase was justified to reflect the current market at the time the building was completed; Retained Earnings was credited for this amount.

v. The board of directors increased the value of the building by $23,000, believing that such an increase was justified to reflect the current market at the time the building was completed; Retained Earnings was credited for this amount.

vi. Engineers estimate the useful life of the building to be 40 years. The company believes that the declining balance method at a 5% rate is appropriate. The company's policy for new PPE is to depreciate the assets according to the time available for use in the fiscal year, rounded to the closest month.

Required:

Prepare entries to reflect correct land, factory building, and accumulated depreciation accounts at December 31, 2012. Round values to the nearest dollar, if necessary.

Definitions:

Self-sufficient

The ability of an individual, community, or country to provide for their own needs without external assistance, particularly in terms of producing food and goods.

Manufactured Goods

Items that have been processed from raw materials into finished products through human or machine labor.

Slaveholders

Individuals or entities that owned one or more slaves, maintaining control over their lives, labor, and freedom.

European Immigrants

Individuals from Europe who have moved to another country, historically significant in the context of migration to the Americas, Australia, and other regions.

Q2: What is "agricultural activity"?<br>A)The harvested product of

Q12: What journal entry is required when inventory

Q48: Which criteria under IAS 38 would be

Q51: The government just released international exchange rate

Q54: Welcome Corporation purchased equipment for $267,000. The

Q67: What is the meaning of "historical cost"?<br>A)The

Q72: Which of the following is NOT true

Q76: Which statement about "cash and cash equivalents"

Q113: Assume that ending inventory in fiscal 2012

Q143: Explain how a merchandising company can manipulate