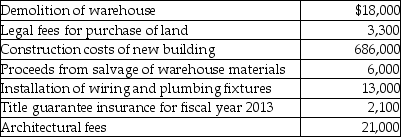

Grape Company (GC)had been renting an office building for several years. On January 1, 2013, GC decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $350,000. Other costs included the following:

Required:

Required:

a. Calculate at what amount GC should record the (i)land and (ii)building.

b. Assume that the building was completed and occupied on December 31, 2013. It has an estimated useful life of 40 years, with residual value of $140,000. Calculate depreciation for 2014 using (i)the straight-line method and (ii)the double declining balance method.

c. Assume that management decided to use straight-line depreciation for the building. By 2017 GC had

grown considerably and needed to relocate for more space; it sold the land and building to Macaw Company on July 1, 2017 for $1,350,000. Assume depreciation expense has already been recorded for the first six months of the year (Jan. 1, 2017 to June 30, 2017). Prepare all journal entries required relating to the land and building accounts on July 1, 2017.

Definitions:

Automatic Thinking

Quick, reflexive thoughts that occur without conscious effort, often based on schemas or past experiences.

Deliberate Thinking

The process of consciously and intentionally focusing on specific thoughts or problems, often associated with careful decision-making and problem-solving.

Efficiency

The ability to accomplish a task or produce a desired outcome with the least amount of waste, expense, or unnecessary effort.

Information

Data processed or stored by a system, person, or organization that is useful for making decisions or solving problems.

Q17: Jasper Pernik is a currency speculator who

Q18: Even though household debt as a percentage

Q20: Discuss three factors that are important in

Q22: Empirical tests prove that PPP is an

Q34: How does counterparty risk influence a firm's

Q43: Explain how non-current assets that are held

Q58: Explain the nature of and the impact

Q59: Plastic Moulds purchased equipment on January 1,

Q84: In December 2012, Ami, the owner of

Q89: Based on the following information, what is