The following transactions occurred in fiscal 2012:

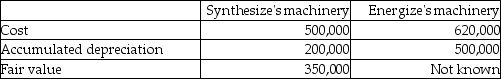

•Synthesize Inc. exchanged machinery with Energize Corp.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Accounts Receivable

Funds that customers owe to a business for products or services already provided but not yet compensated for.

Net Profit Margin Ratio

A financial metric indicating the percentage of revenue remaining as profit after all expenses, taxes, and costs have been deducted.

Cash Flow

The total amount of money being transferred into and out of a business, especially as affecting liquidity.

Liquidity Ratios

Financial ratios that measure a company's ability to meet its short-term obligations, such as current ratio and quick ratio.

Q18: Examples of a business motivation for long-run

Q18: _ states that nominal interest rates in

Q19: Assume that a purchase invoice for $1,000

Q26: What journal entry is required when inventory

Q33: Why are foreign currency futures contracts more

Q34: How does counterparty risk influence a firm's

Q43: The three stages of the global credit

Q50: Which item is an example of real

Q73: Explain how earnings can be manipulated through

Q144: Which statement best explains the retail inventory