The following transactions occurred in fiscal 2012:

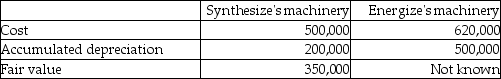

•Synthesize Inc. exchanged machinery with Energize Corp.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Direct Labor Costs

Expenses directly associated with the labor used in the production of goods or services, such as wages for workers on the assembly line.

Overapplied Overhead

Refers to a situation where the applied (or allocated) manufacturing overhead costs are greater than the actual manufacturing overhead costs incurred.

Underapplied Overhead

Underapplied overhead occurs when the allocated manufacturing overhead costs are less than the actual overhead costs incurred.

Raw Materials

Basic substances in their natural, modified, or semi-processed state, used as an input to a production process for manufacturing finished goods.

Q6: The transition to floating exchange rate regimes

Q32: Which of the following is not a

Q48: If a market basket of goods cost

Q66: _ are agents who facilitate trading between

Q69: International debt security purchases and sales are

Q71: Based on the following information, what amount

Q86: Which statement best explains the specific identification

Q111: Satellite Corporation has the following investments at

Q115: Comfy Feet manufactures slippers. In 2011, the

Q133: Amacon Corporation has the following investments at