The following transactions occurred in fiscal 2012:

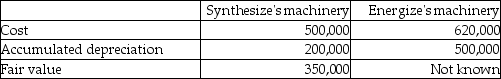

•Synthesize Inc. exchanged machinery with Energize Corp.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Ecological Footprint

A measure of how much natural resources an individual or population consumes compared to how much nature can regenerate.

Ecological Capacity

The natural capacity of ecosystems to support life forms, including their ability to regenerate resources and absorb waste.

Runoff Curtains

Structures or devices used to control or redirect the flow of surface water to prevent soil erosion or water pollution.

Construction Site

A location where construction work is being carried out, involving activities like building, repair, demolition, and excavation.

Q8: Financial derivatives are powerful tools that can

Q14: The process of turning an illiquid asset

Q19: If the forward exchange rate is an

Q21: Which statement is not correct?<br>A)Goodwill represents the

Q28: What definition is used for "market" under

Q56: New Ventures Corp., a publicly accountable entity,

Q61: _ is the cross-border purchase of assets

Q88: How does having significant influence over an

Q100: Sigma Company has a piece of equipment

Q119: Identify whether each of the following items