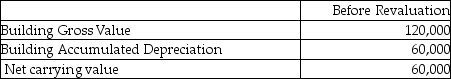

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?

Definitions:

Prior Service Cost Amortization

involves the gradual recognition of the expenses related to pension plan benefits earned by employees in previous periods, over current and future periods.

Defined Benefit Pension Plan

A retirement plan where employee benefits are calculated using a formula that considers factors like length of employment and salary history, with the employer bearing the investment risk.

Projected Benefit Obligation

The present value of all the benefits earned by employees, according to their pension plan up to the measurement date.

Amortization of Prior Service Cost

The process of gradually recognizing the costs of benefits earned by employees in earlier periods in the pension expense over the service life of the employees.

Q16: In 2012, New Wave Inc. (NW)set up

Q17: The _ is a derivative forward contract

Q21: A/an _ quote in the United States

Q41: Which statement is correct about a financial

Q54: What information is not necessary about discontinued

Q60: Which goods in transit would be recorded

Q99: Which statement best depicts the inventory cost

Q104: What is a "disposal group"?<br>A)A component of

Q126: What is the effect of overstating 2012

Q137: Which statement best explains the weighted average