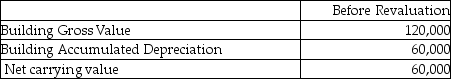

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Shame

A complex emotion that combines feelings of dishonor, unworthiness, and embarrassment arising from the perceived judgement of others.

Embarrassment

A emotional state experienced when one's actions, characteristics or circumstances are perceived as socially awkward or inappropriate.

Reaction To Pain

Describes the immediate response or behavior exhibited by an organism in response to a painful stimulus.

Fear Of Strangers

an anxiety disorder characterized by an intense fear or apprehension when one is around or anticipates interaction with strangers.

Q7: Direct intervention for currency valuation involves limiting

Q13: Which of the following is a difference

Q14: Elyse Inc. made the following investments during

Q22: A _ is a securitized financial instrument

Q43: Which statement best explains the gross margin

Q63: A contract to deliver dollars for euros

Q64: Which of the following is correct with

Q72: Which statement is correct about cost allocation

Q72: Research Corp., a publicly accountable entity, incurred

Q87: Speakspere Partners is scaling back operations; the