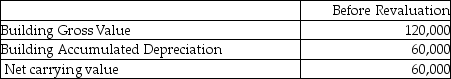

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Potentially Efficient

A state where resources could be allocated in a way that no one could be made better off without making someone else worse off.

High-Income Families

Households that earn a significantly higher income than the average, often placed within the top income brackets for a particular region, influencing their spending, saving, and investment behavior.

Low-Income Families

Households that earn significantly less income than the average for their location or society, often qualifying them for certain types of financial aid.

Efficient Allocation

The optimal distribution of resources among competing uses, allowing for the best possible achievement of goals with minimal wasted effort or expense.

Q5: The British Bankers Association (BBA)estimates that LIBOR

Q13: If the current exchange rate is 113

Q22: Members of the International Monetary Fund may

Q23: While trading in foreign exchange takes place

Q42: Using the following cost information regarding finished

Q51: A fire destroyed the inventory of Mantis

Q59: Refer to Instruction 8.1. After the fact,

Q66: Which statement is correct about using a

Q89: Which statement is not correct about "control"?<br>A)Control

Q91: Gigantic Corp acquired a machine from Miko