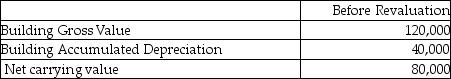

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Rights And Freedoms

Fundamental principles that recognize and protect the liberty and entitlements of individuals, often enshrined in laws and constitutions.

Legal System

A framework of rules, procedures, and institutions through which a society enforces its legal policies and regulates conduct.

Psychologists

Professionals specialized in the study and treatment of cognitive, emotional, and behavioral aspects of human behavior.

Q4: A particular production process requires two types

Q4: Explain when a non-current asset is impaired.

Q11: The international credit crisis began in full

Q18: Even though household debt as a percentage

Q32: Which of the following is NOT another

Q41: Which statement is correct about a financial

Q54: Welcome Corporation purchased equipment for $267,000. The

Q59: Patent Corp., a publicly accountable entity, incurred

Q71: Based on the following information, what amount

Q117: Wilson Inc wishes to use the revaluation