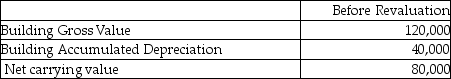

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

National Industrial Recovery Act

A 1933 U.S. legislation aimed at boosting economic growth during the Great Depression through industrial codes of fair competition and promoting the establishment of labor standards.

Unconstitutional

Actions, laws, or policies that do not conform to the principles or provisions outlined in a country's constitution, thus deemed invalid or illegal.

Codes of Fair Competition

Regulations or standards designed to ensure fair practices in business and industry, often relating to labor and trade.

Railway Labor Act

A United States federal law that aims to substitute bargaining, arbitration, and mediation for strikes in resolving labor disputes in the railway and airline industries.

Q1: The member nations of the European Union

Q8: Financial derivatives are powerful tools that can

Q9: Which of the following is NOT an

Q10: The members of the EU do have

Q13: Which of the following is a difference

Q20: _ states that differential rates of inflation

Q38: Johnson Ltd. began operations on January l,

Q63: A firm with variable-rate debt that expects

Q105: On January 1, 2013, a company pays

Q130: ACE Inc has the following investments at