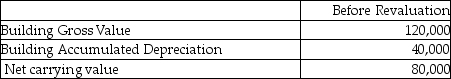

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates higher volatility than the market average.

Risk-Free Rate

The return expected from an investment that carries no risk of loss.

Expected Return

The mean value of the probability distribution of possible returns for a specific investment or portfolio.

Multistage DDM

A version of the Dividend Discount Model that accounts for different growth rates over various stages in a company's lifecycle.

Q7: Business firms in countries with exchange controls,

Q8: JP Corporation had net income of $1,000,000

Q13: Under a fixed exchange rate system, the

Q22: If the direct quote for a U.S.

Q30: According to the International Fisher Effect, the

Q37: Future financial market regulation must include all

Q50: Kryan Corp. mines and produces aluminum. During

Q65: The major difference between currency futures and

Q85: Which statement is correct about joint arrangements?<br>A)ASPE

Q117: Wilson Inc wishes to use the revaluation