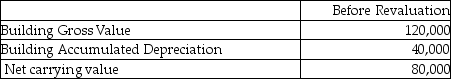

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Lag Indicators

Measures that reflect the success or failure after the fact, helping businesses understand the results of past actions or events.

Balanced Scorecard

A strategic planning and management system used by organizations to communicate what they are trying to accomplish and measure progress towards their goals.

Performance Measures

Quantitative indicators used to assess how well an organization or individual is achieving its goals and objectives.

Gross Cost

The total cost incurred before deducting any discounts, allowances, or rebates.

Q2: Explain why the absorption costing method is

Q7: How is an impairment loss allocated to

Q9: The Gramm-Leach-Bliley Financial Services Modernization Act of

Q25: A call option whose exercise price is

Q25: Since 2009 the IMF's exchange rate regime

Q52: Explain why non-current assets held for sale

Q57: Refer to Instruction 8.1. Which strategy (strategies)will

Q74: What is the meaning of "control"?<br>A)The power

Q87: Assume that a purchase invoice for $1,000

Q93: When can inventory be overstated under the