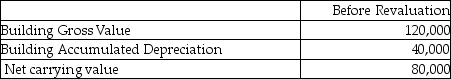

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Activity-Based Costing

Activity-based costing is an accounting method that assigns costs to products or services based on the activities that go into producing them, thereby giving more accurate insights into the costs and profitability of each.

Facility Sustaining Costs

Expenses incurred to maintain the operational capacity of a physical facility or infrastructure, excluding costs related to direct production activities.

Cleaning

The process of removing contaminants, dirt, and impurities from objects and environments, often for maintaining health and hygiene.

Custodial Work

The cleaning, maintenance, and upkeep tasks performed to manage and maintain buildings and facilities.

Q13: Which of the following is a difference

Q22: Dianna Co. prepares monthly income statements. Inventory

Q24: Explain how goodwill arises in a business.

Q39: Which of the following is correct with

Q42: Wallace Inc wishes to use the revaluation

Q43: Most option profits and losses are realized

Q47: GoodResources incurred the following costs: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2820/.jpg"

Q52: Explain why non-current assets held for sale

Q91: Gigantic Corp acquired a machine from Miko

Q138: Which of the following is correct about