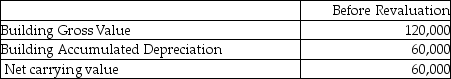

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Forced Compliance

A situation where individuals are compelled to act in a way that contradicts their beliefs or feelings, often leading to cognitive dissonance.

Bystander Intervention

The act of stepping in to help or prevent harm when witnessing an emergency or a situation where someone is in need.

Intrinsic Motivation

The internal drive to perform an activity for its own sake and personal rewards, rather than for some external reward or pressure.

Preference for Consistency

A psychological trait that denotes a person's desire to maintain uniformity and coherence among their beliefs, values, and actions.

Q7: What is the Official Reserves Account (ORA),

Q13: From the viewpoint of a British investor,

Q20: Refer to Table 6.1. The ask price

Q24: The subcategory that typically dominates the current

Q39: The theory of _ states that the

Q49: Assume that a call option has an

Q49: Patent Corp., a publicly accountable entity, purchased

Q68: Fish Corp. purchases a $100,000 face value

Q79: Copi Corp. purchased a bond with a

Q93: Which statement is correct about joint arrangements?<br>A)An