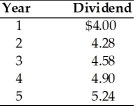

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

Definitions:

Inkblot Analysis

A projective psychological test wherein individuals interpret inkblots, used to uncover emotional drives or issues.

Career-Oriented

Refers to individuals or cultures that prioritize career advancement and professional success as central to their identity or societal values.

College Students

Individuals enrolled in an institution of higher education, usually pursuing undergraduate degrees.

Marry Later

A societal trend or individual decision to delay marriage until an older age compared to traditional norms.

Q10: Saving too much for short-term needs does

Q17: Your net worth will be increased by

Q36: If John had disability insurance coverage from

Q65: The weighted average cost of capital (WACC)

Q70: Which of the following items is not

Q80: The longest period of disability coverage is

Q83: The creation of a portfolio by combining

Q96: A(n) _ is a paid individual, corporation,

Q98: Using the data from Table 8.3, what

Q114: A firm can retain more of its