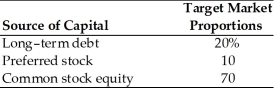

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Long-Duration Bonds

Bonds with a long time remaining until maturity, typically more sensitive to interest rate changes and offering potentially higher yields.

Zero-Coupon Bond

A debt security that does not pay interest but is traded at a deep discount, offering profit at maturity when it reaches face value.

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to changes in interest rates, typically expressed in years.

Bond Convexity

A measure of the curvature or the degree of the curve in the relationship between bond prices and bond yields, demonstrating how the duration of a bond changes as the interest rate changes.

Q3: One of the considerations in determining your

Q17: Your net worth will be increased by

Q19: Brad earns $50 000 per year as

Q78: The term structure of interest rates is

Q85: Tom purchased disability insurance that will provide

Q105: Investing can help your financial plan by<br>A)using

Q138: A conversion feature in a bond allows

Q154: An accidental death rider will provide<br>A)insurance coverage

Q169: Edward Accounting Services has an outstanding issue

Q211: An A rated bond should provide investors