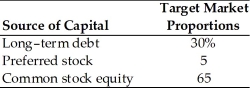

A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. It is expected that to sell, a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Traditional Gender Roles

A set of societal norms dictating what types of behaviors are generally considered acceptable, appropriate, or desirable for a person based on their actual or perceived sex.

Benefits

Forms of value, often related to employment or insurance, provided to individuals in addition to salary, including medical insurance, pension, and holidays.

Costs

The amount of money required for the production, maintenance, or acquisition of goods and services.

Androgynous Individuals

People who do not fit neatly into the conventional gender roles of male or female, often blending or embracing characteristics of both.

Q26: One advantage of purchasing universal life insurance

Q40: Which of the following is an example

Q64: Dilution of ownership occurs when a new

Q74: A firm has the balance sheet accounts,

Q90: Although preferred stock provides added financial leverage

Q116: The firm's before-tax cost of debt is

Q125: Emmy Lou, Inc. has an expected dividend

Q133: A preferred stockholder is sometimes referred to

Q167: Additional insurance commonly offered through employers includes<br>A)dental

Q172: The market segmentation theory suggests that the