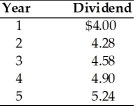

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

Definitions:

Leverage

The use of borrowed funds with the aim to increase the potential return of an investment.

Capital Mix

Capital mix refers to the combination of debt and equity financing used by a company to fund its operations and growth.

Retained Earnings

The portion of a company's profits that is retained or kept in the company rather than paid out to shareholders as dividends.

Flotation Cost

Expenses incurred by a company during the issuance of new securities, including underwriting fees and legal costs.

Q24: An action on the part of a

Q34: A(n) _ portfolio maximizes return for a

Q66: _ is the actual amount each common

Q84: Restrictive covenants place operating and financial constraints

Q113: The free cash flow valuation model is

Q122: Most people obtain health insurance through group

Q141: Which of the following is not an

Q157: A call feature is a feature that

Q179: Upward-sloping yield curves result from higher future

Q209: Nico Nelson, a management trainee at a