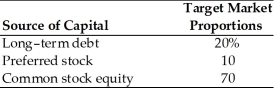

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's before-tax cost of debt is ________. (See Table 9.1)

Definitions:

Resumé

A document summarizing an individual's work experience, education, skills, and achievements, used for job applications.

Keywords

Specific words or phrases that capture the essential subjects or concepts of a document, webpage, or speech, often used for emphasis or retrieval.

Job Description

An official description of a worker's obligations, tasks, and the extent of their position in a company.

Resumé

A document detailing an individual's background, skills, and qualifications, typically used for job applications.

Q31: Tangshan China's stock is currently selling for

Q38: Sam's annual income is $50 000 and

Q50: Under which component of a financial plan

Q61: Which of the following is true of

Q89: Any action taken by a financial manager

Q126: A debt instrument indicating that a corporation

Q127: Goals with a time frame of five

Q132: Policy premiums for long-term care insurance are

Q172: For a risk-indifferent manager, no change in

Q208: In theory, the rate of return on