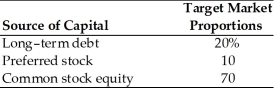

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's after-tax cost of debt is ________. (See Table 9.1)

Definitions:

Hypothetical Syllogism

A logical argument consisting of two conditional statements and a conclusion that is logically inferred.

Modus Ponens

A form of deductive reasoning that asserts if a conditional statement "If P, then Q" is accepted as true and P is true, then Q must also be true.

Modus Tollens

A method of logical argument that infers the falsehood of a proposition from the impossibility of its consequence.

Hypothetical Syllogism

A form of reasoning where if the first condition holds, then the second condition must follow, leading to a conclusion if the initial hypothesis is true.

Q31: Tangshan China's stock is currently selling for

Q33: Which of the following is true of

Q46: The required return is assumed to be

Q47: Longer the maturity of a Treasury security,

Q77: _ means that subsequent creditors agree to

Q111: _ rate of interest creates equilibrium between

Q112: Which of the following would defeat the

Q156: What could happen to you if you

Q163: A firm has experienced a constant annual

Q188: The use of the _ is especially