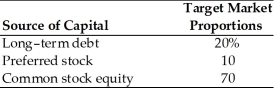

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Dopamine Neurons

Neurons that produce and release dopamine, a neurotransmitter that plays a key role in reward, motivation, memory, attention, and even regulating body movements.

Role Models

Individuals whose behavior, example, or success is or can be emulated by others, especially by younger people.

Smoking

The act of inhaling and exhaling the smoke of burned substances, most commonly tobacco, which is associated with a range of health risks including respiratory diseases and cancer.

Stressful

Characterized by or causing mental, emotional, or physical strain or tension.

Q18: When calculating the amount of life insurance

Q21: In comparison to an equivalent amount of

Q23: Financial advisers are in demand because many

Q73: One major expense associated with issuing new

Q117: Historical weights are the present value of

Q123: Combining uncorrelated assets can reduce risk-not as

Q146: To sell a callable bond, the issuer

Q148: Universal life insurance is the same from

Q159: If the risk-free rate decreases due to

Q182: Which is the most important difference between