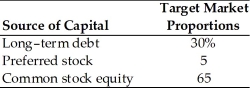

A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. It is expected that to sell, a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Blu-ray Players

Devices designed to play Blu-ray discs, which are used for storing and viewing high-definition video and data.

Trade Discount

A reduction on the list price granted by a seller to a buyer based on the volume of the transaction or the buyer's trade status.

Power Saw

A mechanical tool used for cutting through materials like wood, metal, or plastic with a sharp, toothed blade that moves rapidly.

Net Price

The price of a good or service after all discounts, rebates, and allowances have been subtracted from the gross price.

Q5: In a bond indenture, subordination is the

Q15: A coinsurance of 20 percent on a

Q17: What is the expected risk-free rate of

Q49: The more certain the return from an

Q56: After your financial plan is developed, it

Q78: Even if you diversify your investments, you

Q84: An important step in developing a financial

Q99: Small business investment companies (SBICs) are corporations

Q132: Policy premiums for long-term care insurance are

Q163: For a risk-averse manager, the required return