Multiple Choice

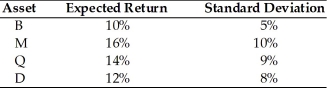

Given the following expected returns and standard deviations of assets B, M, Q, and D, which asset should the prudent financial manager select?

Definitions:

Related Questions

Q6: If expected return is less than required

Q22: A bond with short maturity has less

Q30: Using the Capital Asset Pricing Model (CAPM),

Q42: Which of the following goals would be

Q47: Although a firm's existing mix of financing

Q55: Most Canadians are capable enough to understand

Q67: Supervoting shares of common stock provide shareholders

Q68: Personal finance does not include the process

Q72: Nico Trading Corporation is considering issuing long-term

Q78: In the early earnings life stage of