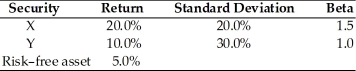

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

Definitions:

Lens Of The Eye

A transparent structure behind the iris that focuses light rays onto the retina, allowing for clear vision at various distances.

Retina

The light-sensitive layer at the back of the eye that converts light into neural signals for visual recognition by the brain.

Neural Pathway

A series of connected neurons that transmit signals between different parts of the brain or between the brain and the rest of the nervous system.

Fovea

A small depression in the retina of the eye where visual acuity is highest, due to a high concentration of cones.

Q20: Calculate the future value of $4,600 received

Q31: Although average household income rose by 11.6

Q36: When a bond's required return is greater

Q65: The book value per share of common

Q74: A corporate financial analyst must calculate the

Q76: Floating-rate bonds are bonds that can be

Q84: An important step in developing a financial

Q101: Treasury stocks held within the corporation do

Q122: A proxy battle is the attempt by

Q169: Edward Accounting Services has an outstanding issue