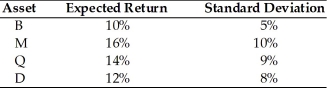

Given the following expected returns and standard deviations of assets B, M, Q, and D, which asset should the prudent financial manager select?

Definitions:

Economies of Scope

Economies of scope occur when producing a wider variety of goods or services reduces the cost of production due to shared inputs or knowledge.

Scale Economies Index

A measure of the cost advantages that enterprises obtain due to their scale of operation, typically associated with cost per unit of output decreasing with increasing scale.

Cost-Output Elasticity

A measure of how the total cost of production responds to a change in the quantity of output produced.

Cost Function

A mathematical representation of how a firm's costs change with different levels of output, typically showing the relationship between costs and output quantity.

Q20: A complete financial plan does not include<br>A)managing

Q24: The best time to buy a whole

Q101: Treasury stocks held within the corporation do

Q113: The free cash flow valuation model is

Q123: Employment Insurance (EI)does not provide adequate coverage

Q133: A preferred stockholder is sometimes referred to

Q135: The liquidity preference theory suggests that the

Q163: A firm has experienced a constant annual

Q173: The expected value and the standard deviation

Q185: A yield curve that reflects relatively similar