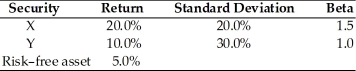

Table 8.3

Consider the following two securities X and Y.

-Which security (X or Y) in Table 8.3 has the least total risk? Which has the least systematic risk?

Definitions:

Decision Alternatives

Different courses of action that can be taken in a decision-making process to achieve a specific goal or solve a particular problem.

Future Demands

The anticipated requirements or needs in upcoming periods, often used in planning and forecasting in various fields such as market trends, technology, and resource allocation.

Fixed Costs

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance premiums.

Net Present Value

A financial metric used to estimate the value of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows.

Q24: James plans to fund his individual retirement

Q66: _ is the actual amount each common

Q81: Determining how much money you should set

Q103: Tangshan China's stock is currently selling for

Q104: To a buyer, an asset's value represents

Q114: In the capital asset pricing model, the

Q138: Nico bought 500 shares of a stock

Q153: For a risk-seeking manager, no change in

Q159: What is the value of an asset

Q162: A firm has to pay a dividend