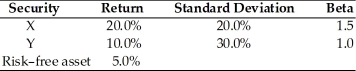

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

Definitions:

Federal Reserve Bank

The central banking system of the United States, established in 1913, which aims to provide the nation with a safer, more flexible, and stable monetary and financial system.

Economic Speculation

The practice of engaging in risky financial transactions in an attempt to profit from short or medium-term fluctuations in the market value of a tradable financial instrument.

Alan Greenspan

Former Chairman of the Federal Reserve of the United States, who served from 1987 to 2006 and played a key role in American monetary policy during that period.

Federal Reserve Bank

The Federal Reserve Bank is the central banking system of the United States, which oversees the nation's monetary policy and regulates its financial institutions.

Q14: The most accurate method of determining life

Q17: What is the expected risk-free rate of

Q75: A tax adjustment must be made in

Q85: Tangshan Industries has issued a bond which

Q99: Any Ba rated bond or lower would

Q102: Stock rights provide the stockholder with _.<br>A)

Q115: Which of the following would be the

Q122: A proxy battle is the attempt by

Q129: The real utility of the coefficient of

Q139: The security market line (SML) reflects the