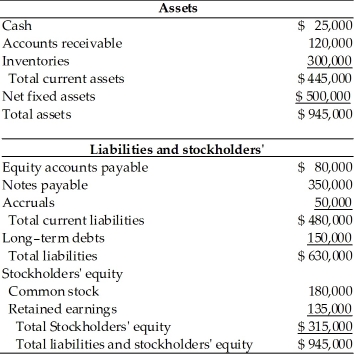

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma net fixed assets amount is ________. (See Table 4.5)

Definitions:

Rule of Law

The principle that all individuals, entities, and government are accountable to laws that are publicly promulgated, equally enforced, and independently adjudicated.

Confiscated

Property that has been taken away from its owner by a governmental authority as a penalty or for regulatory reasons.

Transactional Risks

The potential for financial loss that a company faces when engaging in business transactions, especially in foreign markets.

Customary Law

Laws derived from experience, practice, collective wisdom, and shared philosophy to set the boundaries and rights that define relationships between community members.

Q28: Ratios merely direct an analyst to potential

Q83: Accounting practices and procedures used to prepare

Q89: Key inputs to short-term financial planning are

Q98: A firm with a total asset turnover

Q120: Paid-in capital in excess of par represents

Q130: A _ occurs when the operations of

Q142: A firm's free cash flow (FCF) equals

Q144: On the balance sheet, net fixed assets

Q190: P/E ratio measures the _.<br>A) market value

Q218: The riskiness of publicly traded bond issues