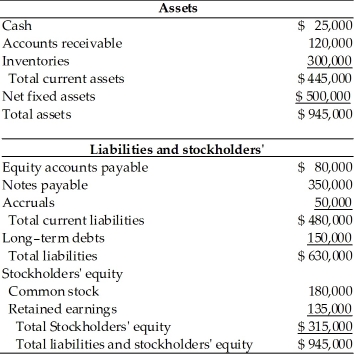

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma total liabilities amount is ________. (See Table 4.5)

Definitions:

Wavelengths

The distance between successive crests of a wave, especially points in a sound wave or electromagnetic wave.

Frequencies

The frequency with which an event happens or is replicated within a specific time frame or sample.

Sensory Adaptation

The process by which sensory receptors become less sensitive to constant stimuli, allowing individuals to focus on changes in their environment.

Perceptual Redundancy

The presence of more sensory information than is necessary for the recognition or understanding of an object or concept.

Q3: Which of the following provides savers with

Q8: Adam borrows $4,500 at 12 percent annually

Q39: The pro forma net profits after taxes

Q56: Short-term financial plans and long-term financial plans

Q58: Calculate a firm's free cash flow if

Q92: In the DuPont system of analysis, the

Q100: A debenture is _.<br>A) a bond secured

Q110: If a bond's required return always equals

Q131: What is the approximate yield to maturity

Q148: A call feature in a bond allows