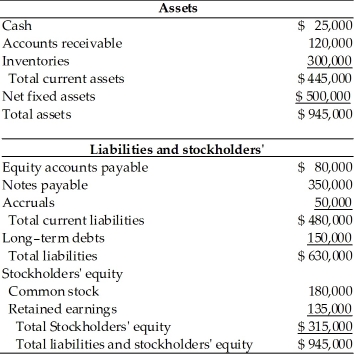

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-General Talc Mines may prepare to ________. (See Table 4.5)

Definitions:

Private Placements

A method of raising capital through the sale of securities to a small number of selected investors rather than through a public offering.

Rights Offering

A financial offering in which a company gives existing shareholders the right to buy additional shares at a discounted price before offering it to the public.

Underwriting Provision

A clause in financial agreements, especially in insurance and securities, where an underwriter commits to buy and resell a specific amount of securities or assumes financial risk for a fee.

Standby Underwriting Agreement

A contract where the underwriter commits to buy any shares not purchased by investors during an initial public offering (IPO) or secondary offering.

Q25: In the Eurobond market, corporations and governments

Q30: The three basic types of risks associated

Q36: Janice would like to send her parents

Q120: An example of a standard debt provision

Q128: In preparing a cash budget, the _

Q130: A _ occurs when the operations of

Q140: Given a financial manager's preference for faster

Q156: The rate of return earned on an

Q183: A congeneric merger is a merger combining

Q186: The combination of two or more companies