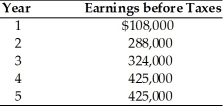

Jia's Oven Manufacturing is evaluating the acquisition of Cuisinaire Kitchen Appliance Co. Cuisinaire has a loss carryforward of $1.5 million which resulted from earlier operations. Jia's Oven can purchase Cuisinaire for $1.8 million and liquidate the assets for $1.3 million. Jia's Oven expects earnings before taxes in the five years following the acquisition to be as follows:  (These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(a) What is the tax advantage of the acquisition each year for Jia's Oven?

(b) What is the maximum cash price Jia's Oven would be willing to pay for Cuisinaire?

(c) Do you recommend the acquisition? Why or why not?

Definitions:

Self-Esteem

An individual's subjective evaluation of their own worth or value, encompassing beliefs about oneself as well as emotional states.

Implicit Memory

A category of memory that facilitates the carrying out of tasks without deliberate awareness of the antecedent experiences.

Memory Network

A conceptual framework involving the interconnectedness of memory stores and processes that work collaboratively to encode, store, and retrieve information.

Defense Mechanism

Unconscious psychological strategies employed to manage stress, anxiety, or uncomfortable feelings.

Q13: A merger occurs when two or more

Q23: Tangshan Mining is attempting to acquire Zhengsen

Q44: Both current and prospective shareholders are interested

Q55: A bond that is sold primarily in

Q67: As a foreign exchange hedging tool, currency

Q89: An important aspect of a firm's reorganization

Q91: Which of the following is true of

Q143: When a firm undertakes a merger to

Q150: Lenders of secured short-term funds prefer collateral

Q158: Leveraged buyouts are clear examples of _.<br>A)