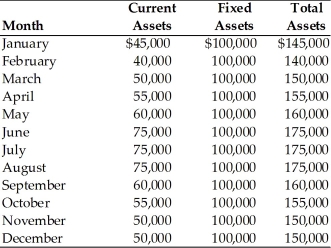

Table 15.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-The firm's monthly average seasonal funds requirement is ________. (See Table 15.1)

Definitions:

Reorganization

The process of restructuring a company's business or financial affairs, typically during financial distress, to increase efficiency or restore solvency.

Liquidation

The process of closing a business and distributing its assets to claimants, typically occurring when a company is insolvent.

Homemade Leverage

A strategy where investors adjust the leverage or risk of their portfolio through borrowing or investing their own money, rather than relying on the company to do so.

Direct Bankruptcy Costs

These are the costs associated directly with the bankruptcy process, including legal fees, accounting fees, and other administrative expenses for processing a bankruptcy filing.

Q2: The call price of a security generally

Q4: Generally, increases in leverage result in increased

Q35: When the price of a firm's common

Q50: Which of the following is an advantage

Q60: The problem with the regular dividend policy

Q86: In a voluntary settlement, one group of

Q91: Dividends are the only means by which

Q93: The market value of a warrant is

Q103: Global Logistics purchased a new machine on

Q195: What is the cost of marginal investments