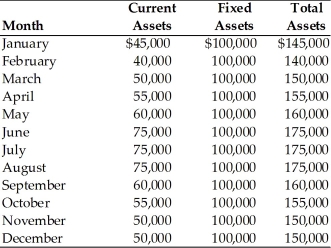

Table 15.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-If the firm's current liabilities in December were $40,000, the net working capital was ________. (See Table 15.1)

Definitions:

Future Outlook

An estimate or forecast of a future situation or trend based on current data or trends.

Nominal Rate

The rate of interest before adjustments for inflation, representing the face value of financial products.

Large-company Stocks

Shares that represent ownership in corporations with large market capitalizations.

Risk Premium

The extra return expected by investors for holding a risky asset compared to a risk-free asset, compensating for the additional risk.

Q51: The relative inexpensiveness of debt capital is

Q59: A decrease in fixed operating costs will

Q98: A firm has an average age of

Q119: According to the residual theory of dividends,

Q129: Derivatives are used by corporations as a

Q131: In a financial statement of the firm,

Q140: In economic conditions characterized by a scarcity

Q150: Lenders of secured short-term funds prefer collateral

Q176: One major risk a firm assumes in

Q334: A major decision confronting a business firm