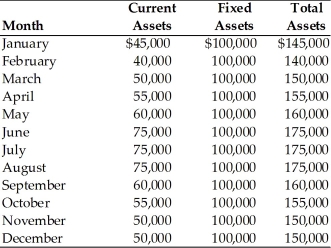

Table 15.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-The firm's annual financing costs of the aggressive financing strategy are ________. (See Table 15.1)

Definitions:

Controllable Cost

Expenses that can be influenced or managed by decisions made by a manager or a business, such as materials or labor.

Supervisor

An individual in charge of overseeing and directing the work of a group of people.

Direct Materials

Raw materials that are used in the manufacturing process and are directly incorporated into the finished product.

Direct Labor

The wages and associated costs for employees who are directly involved in the production of goods or services.

Q14: The firm's monthly average seasonal funds requirement

Q25: The market value of a convertible security

Q42: By purchasing shares through a firm's dividend

Q102: The yield on commercial paper is generally

Q106: One advantage of factoring accounts receivable is

Q114: A firm has EBIT of $375,000, interest

Q153: Technical insolvency occurs when a firm's liabilities

Q166: When a firm stretches accounts payable without

Q177: A firm's credit selection procedures must be

Q271: A credit applicant's _ is his or