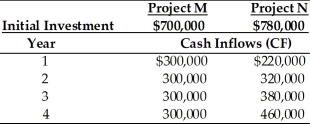

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the NPV for Project M is ________. (See Table 12.3)

Definitions:

Shareholders Equity

The residual interest in the assets of a corporation after deducting its liabilities, representing the amount that would be returned to shareholders if all assets were liquidated and all debts repaid.

Closing Rate

The exchange rate used to convert foreign currency-denominated financial statements of a subsidiary into the reporting currency of the parent company at the balance sheet date.

Foreign Subsidiary

A company that is completely or partially owned and controlled by another company, but operates in a different country than the parent company.

Functional Currency

The currency of the primary economic environment in which an entity operates, usually reflected in its financial statements.

Q3: In capital budgeting, the preferred approaches in

Q8: A firm is evaluating a proposal which

Q28: XML.<br>A)A programming language that converts unstructured data

Q30: At about what EBIT level should the

Q32: In capital budgeting, risk is generally thought

Q39: Which of the following legal forms of

Q42: The _ has/have the ultimate responsibility in

Q42: Generally, the greater a firm's times interest

Q72: What is metadata?<br>A)Data about financial reports<br>B)Data about

Q142: _ is the potential use of fixed