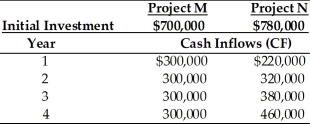

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the better investment for Tangshan Mining is ________. (See Table 12.3)

Definitions:

Retention Ratio

The percentage of net income that is retained by a company rather than distributed to its shareholders as dividends.

Quarterly Earnings

A corporation's earnings reported on a quarterly basis, giving investors and analysts an interim view of financial performance and profitability.

Stock Split

A company strategy to divide its existing shares into a larger number of shares to enhance the liquidity of the shares.

Market Price

The now prevailing cost at which one can buy or sell an asset or service.

Q20: Commercial paper is a short-term loan issued

Q39: How is XBRL being used in Asia?

Q42: The _ has/have the ultimate responsibility in

Q61: If an asset is depreciable and used

Q65: Tangshan Mining Company, with a cost of

Q73: Purchasers of a stock selling ex dividend

Q86: Which of the following forms of organizations

Q90: Which of the following is a strength

Q208: Fixed financial charges include _.<br>A) common stock

Q212: A firm's capital structure can significantly affect