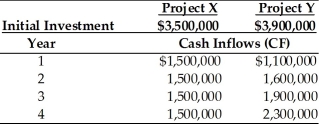

Table 12.5

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, find the NPV for projects X and Y. Which project should Nico select using this method? (See Table 12.5)

Definitions:

Typical

Representing the characteristics or qualities of a particular group, category, or class; characteristic.

Frequency Judgment

The process of estimating the rate at which an event occurs or the likelihood of its occurrence.

Availability

The extent to which a resource or service can be used or obtained.

Representativeness Heuristic

A cognitive shortcut used in decision making and judgments, where the likelihood of an object or event is assessed based on how closely it matches the typical case or stereotype.

Q6: Companies involved in international capital budgeting projects

Q12: Breakeven analysis is used by a firm

Q16: The break even cash inflow is the

Q43: A firm's dividend payout ratio is calculated

Q62: One type of simulation program made popular

Q70: The tax treatment regarding the sale of

Q81: Dividends provide information about a firm's current

Q81: A firm with unlimited funds must evaluate

Q127: Holding all other factors constant, a firm

Q164: The payback period of a project that