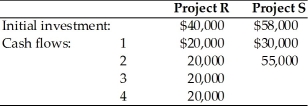

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

Definitions:

Law of Comparative Advantage

The principle that a country should specialize in producing and exporting goods in which it has the lowest opportunity cost and import goods in which it has a comparative disadvantage.

Specialization

The process of focusing on a limited range of goods or services to gain efficiency or expertise.

Trading Partners

Countries, organizations, or individuals that engage in the exchange of goods, services, or information.

Joint Output

Products or services that are produced together in the course of a single production process, often resulting in a correlation between their quantities or prices.

Q36: The appeal of the IRR technique is

Q53: If a firm has overdue liabilities or

Q59: A decrease in fixed operating costs will

Q75: Firms do not usually get rewarded by

Q103: Exchange rate risk is easier to protect

Q129: An excess earnings accumulation tax is levied

Q164: The payback period of a project that

Q172: Which of the following is a reason

Q176: Operating leverage measures the effect of fixed

Q192: The pecking order explanation of capital structure