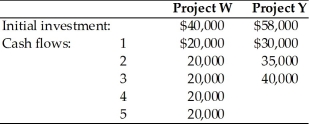

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 18 percent, and the projects have the following initial investments and cash flows:

Definitions:

Air Passageways

The routes throughout the respiratory system, including the nose, throat, windpipe, and lungs, through which air is inhaled and exhaled.

Radioactive Chemical

A substance that contains unstable atoms which release radiation as they decay.

PET Scan

Positron Emission Tomography, a sophisticated imaging technique that uses radioactive substances to visualize and measure changes in metabolic processes and in other physiological activities including blood flow, regional chemical composition, and absorption.

Tracer

A radioactive substance used in medical imaging or scientific research to track the presence or distribution of substances within the body or environment.

Q11: The net present value of the project

Q30: In case of international capital budgeting, a

Q44: Projects with a small chance of being

Q59: A decrease in fixed operating costs will

Q86: The information content of dividends refers to

Q87: Mutually exclusive projects are those whose cash

Q111: Opportunity costs should be included as cash

Q113: A firm has had the following earnings

Q204: _ refers to the effects that fixed

Q238: _ float is the delay between the