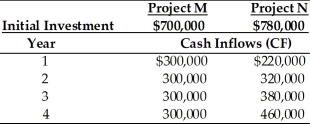

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the NPV for Project M is ________. (See Table 12.3)

Definitions:

Television Remote

A handheld device used to operate a television from a short distance away, allowing the user to change channels, adjust volume, and access other functionalities without directly interacting with the television set.

Bell Canada

A major Canadian telecommunications and media company that provides a wide range of products and services including internet, television, and phone services.

Work Redesign

Involves altering jobs to improve employee satisfaction, productivity, and efficiency, potentially by enhancing job scope, depth, or work processes.

Social Networks

Platforms or communities where individuals can interact, share, and communicate with each other over the internet, or the interconnected structure of social relations.

Q3: The present value of the project's annual

Q9: Marginal analysis states that financial decisions should

Q13: The degree of operating leverage depends on

Q35: The cost of equity increases with increasing

Q62: Which of the following is true of

Q76: One strength of payback period is that

Q82: XBRL is a programming language that is

Q82: Research and development is considered to be

Q99: The book value of the existing asset

Q135: If net present value of a project