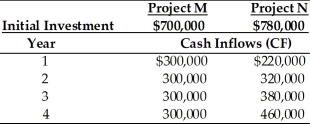

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the better investment for Tangshan Mining is ________. (See Table 12.3)

Definitions:

Price Variance

The difference between the actual cost of a product or service and its standard or expected cost.

Price

The amount of money expected, required, or given in payment for something.

Fixed Budget Performance Reports

Financial reports comparing actual results to a plan that does not change, regardless of the level of activity.

Actual Results

The real, measured outcomes of financial or operational activities within a given period.

Q6: In USA, the FDIC is using XBRL

Q46: The annualized NPV of Project A is

Q68: Cash flows and risk are the key

Q92: Which of the following is one of

Q99: The more fixed cost financing a firm

Q109: Calculate the book value of the existing

Q113: A financial manager must choose between three

Q117: A firm has just ended its calendar

Q127: Holding all other factors constant, a firm

Q165: The ranking approach involves the ranking of