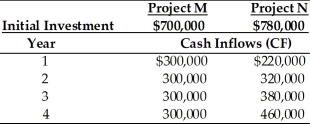

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Which project would be preferable if both projects were of average risk as the overall firm and Tangshan Mining has a beta of 1.0? (See Table 12.3)

Definitions:

IRR

An investment's IRR represents the discount rate that makes the sum of all future cash flows (positive and negative) from the investment equal to zero, effectively measuring its annual growth rate.

NPV

Net Present Value; the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Payback

The length of time it takes for an investment to generate an amount of money equal to the cost of the investment, used as a basic measure of the investment's risk.

Discounted Payback

The period of time it takes for an investment’s cash flows, discounted at a particular rate, to cover its initial cost.

Q51: In selecting the best group of unequal-lived

Q59: A decrease in fixed operating costs will

Q61: Behavioral approaches _.<br>A) are used to explicitly

Q72: In general, non-U.S. companies have much higher

Q73: The new financial analyst does not like

Q80: A _ is a professionally managed portfolio

Q89: The major weakness of payback period in

Q116: Net present value (NPV) assumes that intermediate

Q160: A firm can accept a project with

Q165: The ranking approach involves the ranking of