Table 12.6

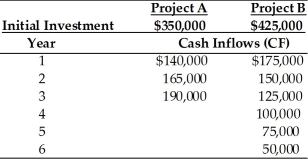

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The NPVs of Projects A and B are ________. (See Table 12.6)

Definitions:

Market Portfolio

A theoretical bundle of all investable assets in the market, with each asset weighted according to its market capitalization.

Risk-Free Asset

An investment with a certain return and no risk of financial loss, typically represented by government securities.

Risk Level

The degree of uncertainty and/or potential financial loss inherent in an investment decision.

Treasury Bills

Short-term government securities issued at a discount from face value and mature in a year or less, representing a safe and liquid investment option.

Q12: If an asset is sold for more

Q12: Which of the following is the responsibility

Q13: The financial manager must look beyond financial

Q30: XBRL shows promise to streamline financial reports

Q92: Rapidly growing firms pay high dividends to

Q94: In case of unequal-lived, mutually exclusive projects,

Q105: Capital budgeting techniques are used to evaluate

Q134: Corporate ethics policies typically apply to _

Q193: The higher the financial breakeven point and

Q332: _ are funds denominated in U.S. dollars