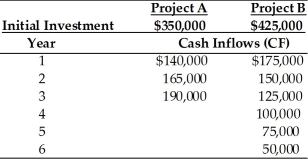

Table 12.6

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-Which project should be chosen on the basis of the normal NPV approach? (See Table 12.6)

Definitions:

Gross Profit

The difference between sales revenue and the cost of goods sold, before deducting overhead, payroll, taxation, and interest payments.

Net Profit

The remaining income after all expenses, taxes, and costs have been subtracted from total revenue.

Value Chain

A series of activities by a firm that adds value to its products or services from conception to delivery.

Primary Processes

The core activities that directly contribute to the production of goods or provision of services in an organization, such as manufacturing, assembly, and service delivery.

Q6: The NPV of a project with an

Q8: In applying risk-adjusted discount rates to project

Q22: The danger that an unexpected change in

Q32: The risk of the debt capital is

Q49: Which project do you recommend? (See Table

Q54: In capital budgeting, risk refers to _.<br>A)

Q59: The cash flow pattern for the capital

Q72: Using certain standardized and generally accepted principles,

Q73: XBRL software tools using a specified taxonomy

Q93: The payment of cash dividends to corporate