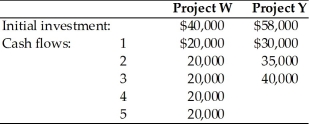

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 18 percent, and the projects have the following initial investments and cash flows:

Definitions:

Oil Well Service Company

An oil well service company provides a range of services to the oil and gas industry, including drilling, maintenance, and completion services for oil wells.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels during a period.

Planning Budget

A budget that outlines the expected revenues, expenses, and resource allocations over a specific period, used for strategic financial planning.

Spending Variance

The difference between the budgeted amount for spending and the actual amount spent.

Q27: Cash flows that could be realized from

Q33: For Proposal 3, the cash flow pattern

Q35: For Proposal 3, the annual incremental after-tax

Q71: The availability of funds for capital expenditures

Q86: Payback is considered an unsophisticated capital budgeting

Q99: Metadata is simply data about data.

Q104: A sophisticated capital budgeting technique that can

Q107: _ is the potential use of fixed

Q193: The higher the financial breakeven point and

Q203: The inexpensive nature of long-term debt in