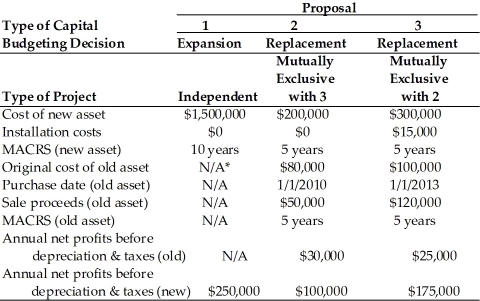

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 1, the initial outlay equals ________. (See Table 11.2)

Definitions:

Appeals

The process by which cases are reviewed, with parties requesting a formal change to an official decision.

Full Court

The term used to refer to all the judges of a certain court sitting together to hear a case, as opposed to a smaller panel of judges.

Federal Appeals Courts

Courts in the United States judicial system that review decisions made by lower courts, including district courts, and are responsible for resolving appeals and legal disputes.

Lower Court Cases

Legal disputes and decisions that are handled in courts with limited jurisdiction, such as municipal or district courts.

Q1: In general, the greater the difference between

Q35: If a project's payback period is less

Q57: In comparing the internal rate of return

Q64: _ costs require the payment of a

Q64: Which of the following is true of

Q70: The basic shortcoming of the EBIT-EPS approach

Q76: Data element<br>A)Unit of measure<br>B)Numeric and nonnumeric facts<br>C)Time

Q104: Given the information in Table 11.4, compute

Q124: Consider the following projects, X and Y

Q135: If net present value of a project